Sports Franchise Fractional Shares: Own the NBA via Blockchain

In 2024, the global sports market reached a total value of $463 billion and is projected to continue expanding at a compound annual growth rate (CAGR) of approximately 7%, potentially surpassing $862 billion by 2033. Within this massive ecosystem, sports franchise rights have long been considered highly attractive investment assets. However, due to their high entry barriers and scarcity, they have remained largely inaccessible to ordinary investors. Now, with the development of blockchain technology, a new opportunity is emerging: tokenized “fractional shares” of sports franchises—offering the chance to “own” a portion of an NBA team.

Why Are Sports Franchises a Goldmine?

In professional sports, franchise rights are not just tickets to join a league—they are exclusive and highly coveted market assets. Take the NBA, for example: its league structure imposes strict limits on expansion, meaning new teams are rarely added. Most cities have just one team, which ensures long-term market exclusivity and value. These teams benefit from a stable local fan base and diversified revenue streams such as media rights, sponsorships, and game-day earnings, making them resilient even in uncertain economic times.

According to data tracked by SportsPro and The Ledge Company, every acquisition or investment deal involving major sports league teams since 2010 has drawn significant attention from investors. Even during economic downturns, elite league teams remain in high demand, with some valued in the billions of dollars.

However, the high capital requirements shut out average investors. Operating a team involves enormous costs, including acquisition fees, player salaries, coaching staff, training programs, and stadium management—often amounting to tens or hundreds of millions of dollars annually—making it prohibitively expensive for retail investors.

Blockchain Opens a New Door: Fractional Ownership

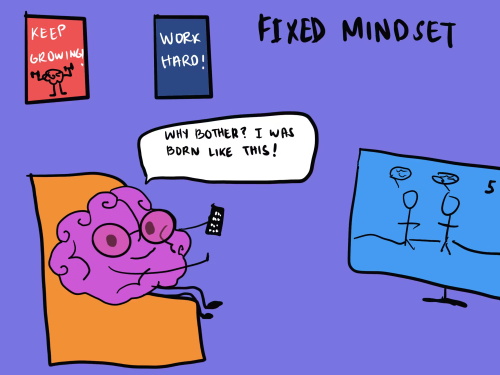

Traditionally, sports franchise investment has been a game for the wealthy. But with the rise of blockchain—especially asset tokenization—this dynamic is starting to change. Asset tokenization refers to converting real-world assets into digital tokens on the blockchain, allowing for fractional ownership, easier transfers, and programmable management. In other words, you don’t have to buy the entire team—you can buy a fraction.

Blockchain’s advantages include the ability to divide assets into smaller units, immutable transaction records, and enhanced transparency—all of which help reduce fraud and build investor trust. Additionally, smart contracts enable automated processes like dividend distribution and voting rights, eliminating the need for intermediaries and increasing efficiency.

The Crypto Push in the Sports Industry

The sports industry’s integration with blockchain and cryptocurrencies is not a new trend. As early as 2014, the NBA’s Sacramento Kings became the first team to accept Bitcoin for tickets and merchandise, setting the stage for digital innovation in sports.

Other teams, like the Los Angeles Dodgers, soon followed with fan engagement experiments using crypto collectibles. In 2018, the Dodgers gave away digital bobblehead NFTs to the first 40,000 fans at a game—these tokens could be added directly to fans’ Ethereum wallets, ushering in a new era of digital sports memorabilia.

NBA Top Shot: Bridging Fans and the League with Blockchain

One standout example of how blockchain is transforming the sports world is NBA Top Shot. Developed by Dapper Labs, this platform allows fans to buy and trade officially licensed NBA highlight clips—called “Moments”—as NFTs. These clips include iconic plays like game-winning shots and key blocks, each with different rarity tiers, recorded immutably on the blockchain.

For the NBA, this creates new monetization channels for content, while for fans, it transforms passive viewership into active ownership. With Top Shot, fans can own a piece of history and even resell it to a global market.

Challenges and the Future of Fractional Ownership

Imagine a future where a platform lets you own 0.0001% of an NBA team via blockchain, earning dividends as the team wins and grows in value. You might even gain limited decision-making rights or exclusive perks—such as voting on jersey designs or receiving VIP access to games—ushering in the era of “fan shareholders.”

However, this vision comes with challenges. Legal and regulatory frameworks around tokenized assets are still unclear in most countries. As shareholder structures become more diversified, ensuring efficient decision-making and aligning interests could become complex. Additionally, team valuations are not guaranteed to rise—they can fluctuate due to performance, management changes, and other variables.

Owning an NBA Team via Blockchain Is No Longer Just a Dream

The fusion of blockchain technology and the sports industry is not only pushing the boundaries of asset investment—it’s also giving fans an unprecedented sense of participation and belonging. From ticketing and tokens to collectibles and potential fractional ownership, this evolution is no longer just theoretical—it’s becoming tangible and practical.